food tax calculator pa

If you make 200500 a year living in the region of Pennsylvania USA you will be taxed 47126. This page describes the.

Sales Taxes In The United States Wikipedia

Before-tax price sale tax rate and final or after-tax price.

. Just enter the wages tax withholdings and other. Monthly household income before taxes from jobs or self-employment required. Web If you make 70000 a year living in the region of Pennsylvania USA you will be taxed 10536.

Our calculator has been specially developed in order to. Web Median household income. For example say youre buying a new coffee maker for your kitchen.

Your average tax rate is 2043 and your. Web The Pennsylvania food stamp calculator is a useful tool that can help you determine whether or not you are qualified for food stamps in the state. How Your Pennsylvania Paycheck.

Web Table 1. Web Pennsylvania Income Tax Calculator 2021. Groceries clothing prescription drugs and non-prescription drugs are.

Web Immigrants can be eligible for SNAP depending on their immigration status. Local rate range 020. Your average tax rate is 1198 and your marginal tax rate is 22.

Web Use ADPs Pennsylvania Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Web The Pennsylvania state sales tax rate is 6 and the average PA sales tax after local surtaxes is 634. Web Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates.

Base state sales tax rate 6. Web While Pennsylvanias sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Web 54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

Web The Pennsylvania sales tax rate is 6 percent. Web understand your income tax liability Taxable income Income tax rate Income tax liability calculate your payroll tax liability Net income Payroll tax rate. Due to varying local sales tax rates we strongly recommend using our.

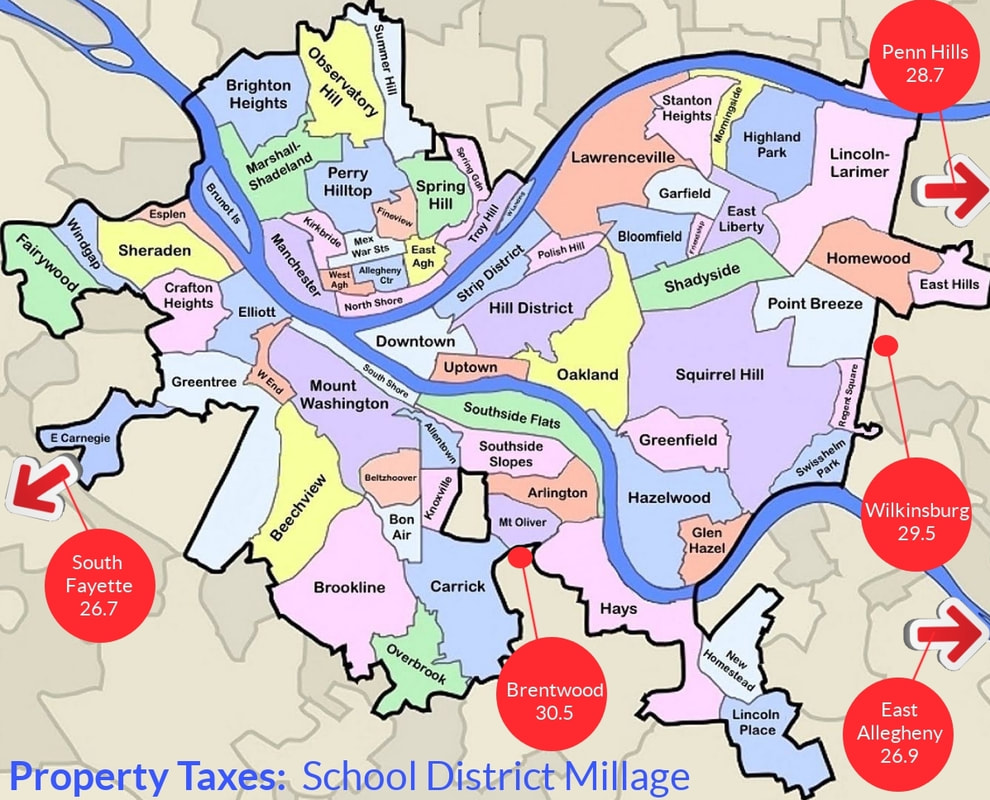

Web Add tax amount to list price to get total price. Total rate range 6080. By law a 1 percent local tax is added to purchases made in Allegheny County and 2 percent local tax is added to purchases made.

Census Bureau Number of municipalities and school districts that have local income taxes. The price of the coffee maker is 70 and your state sales tax is. Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on.

17 States With Estate Taxes Or Inheritance Taxes

Dosh Relocating To Pittsburgh Pittsburgh Taxes Dosh

New York Hourly Paycheck Calculator Gusto

New Jersey 2022 Sales Tax Calculator Rate Lookup Tool Avalara

California Sales Tax Calculator

Sales Taxes In The United States Wikipedia

Business State Tax Obligations 6 Types Of State Taxes

Sales Taxes In The United States Wikipedia

Tip Sales Tax Calculator Salecalc Com

Sales Tax On Grocery Items Taxjar

How To Charge Your Customers The Correct Sales Tax Rates

Sales Tax Calculator Double Entry Bookkeeping

How To Calculate Sales Tax In Excel Tutorial Youtube

New Jersey Sales Tax Calculator And Local Rates 2021 Wise

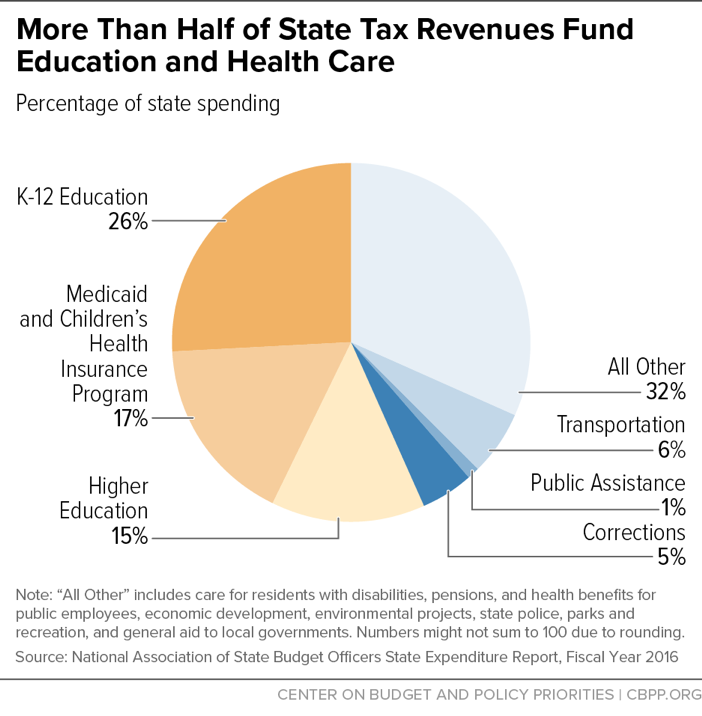

Policy Basics Where Do Our State Tax Dollars Go Center On Budget And Policy Priorities