south dakota excise tax vs sales tax

The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. Owning a car can be rather expensive from the point of buying it.

Sales Taxes In The United States Wikiwand

The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services.

. The South Dakota sales tax and use tax rates are 45. The South Dakota Department of Revenue SDDOR has updated its guidance on the sales tax implications of selling farm machinery. The guidance notes that all sales of farm machinery.

Chapter 10-33 Telephone Companies including Rural. Counties and cities can charge an. The cigarette excise tax in South Dakota is 153 per pack of 20.

Wayfair Sales Tax Contractors Excise. They may also impose a 1 municipal gross. Business Tax includes sales tax use tax.

South Dakota SD Sales Tax Rates by City all The state sales tax rate in South Dakota is 4500. But that is not all as there are other payments you have to make as well. South Dakota Liquor Tax - 393 gallon.

The South Dakota use tax was enacted in 1939. Chapter 10-35 Electric Heating Power Water Gas Companies. Chapter 10-36 Rural Electric Companies.

South Dakotas excise tax on Spirits is ranked 31 out of the 50 states. They may also impose a 1 municipal gross receipts tax MGRT that is in addition to the municipal sales tax. Sales Excise Tax for Municipalities South Dakota Finance Officers School June 2019 Alison Jares Deputy Director of Business Tax South Dakota vs.

Municipalities may impose a general municipal sales tax rate of up to 2. 4500 The state has reduced rates for sales of certain types of. This report is a list of Business Tax delinquent taxpayers 2.

The cigarette excise tax in South Dakota is 153 per pack of 20. The South Dakota retail sales tax was enacted in 1935 and extended to services and professions in 1965. In South Dakota liquor vendors are responsible for paying a state.

The South Dakota Department of Revenue administers these taxes. The South Dakota Department of Revenue Pierre SD ITEMS OF NOTE. South Dakota charges a 4 excise sales tax rate on the purchase of all vehicles.

DAKOTA SOUTH DAKOTA WYOMING. A 2 contractors excise tax is imposed on the gross receipts of all prime and subcontractors engaged in construction services or reality improvement projects. With local taxes the total sales tax rate is between 4500 and 7500.

South Dakotas general sales tax of 45 also applies to the purchase of liquor. The South Dakota excise tax on cigarettes is 153 per 20 cigarettes higher then 54 of the other 50 states. WHAT IS SALES TAX.

South Dakota amended it. The South Dakota Department of Revenue administers these taxes. South Dakota has a motor vehicle excise tax fee of 4 percent of the purchase price.

Additionally South Dakota has a motor vehicle gross receipts tax of 45 percent that. South Dakota Vehicle Excise Tax Explained. Learn what you need to file pay and find information on taxes for the general public.

South Dakota Taxes and Rates State Sales Tax and Use Tax Applies to. Everything you need to know about games licensing and beneficiaries of the South Dakota Lottery. South Dakota has a statewide sales tax rate of 45 which.

Sales Tax Exemptions in South Dakota.

States With The Highest Lowest Tax Rates

Motor Vehicles Sales Amp Repair State Of South Dakota

South Dakota Income Tax Tax Benefits South Dakota Dakotapost

What Transactions Are Subject To The Sales Tax In South Dakota

State Level Sales Taxes On Nonfood Items Food And Soft Drinks And Download Table

5 States Without Sales Tax Thestreet

What Is Excise Tax And How Does It Differ From Sales Tax

Sales Use Tax South Dakota Department Of Revenue

Online Sales Tax In 2022 For Ecommerce Businesses By State

Your Guide To The United States Sales Tax Calculator Tax Relief Center

Curt Massie State Local Tax Managing Member At Dakota Business Tax Llc Sd Sales Use Contractors Excise Tax Services Rapid City South Dakota United States Linkedin

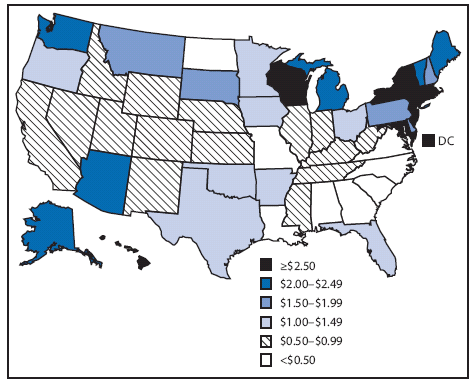

State Cigarette Excise Taxes United States 2009

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

How High Are Spirits Excise Taxes In Your State

How Do State And Local Sales Taxes Work Tax Policy Center

Business Advocate Business Advocacy Law Firm Mcdonald Hopkins Chicago Cleveland Columbus Detroit Miami West Palm Beach

Form Mv 608 Fillable State Of South Dakota Application For Motor Vehicle Title And Registration

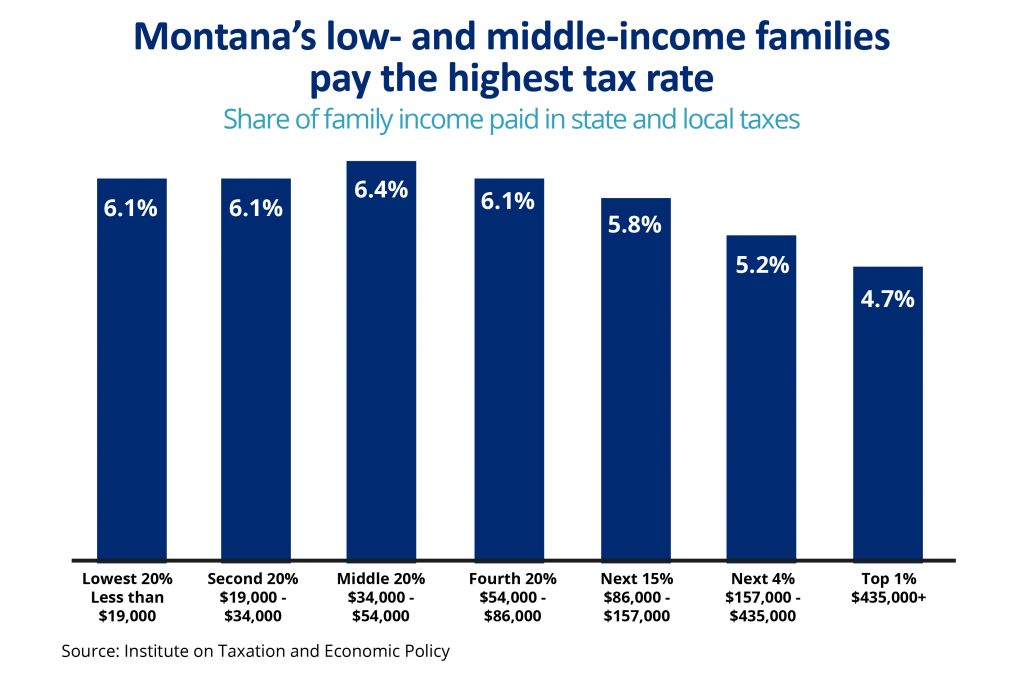

Problems With A Statewide Sales Tax Montana Needs To Help Not Hurt Families Montana Budget Policy Center